In June, cultivated meat was officially ok’d to enter the U.S. market after the USDA granted regulatory approval to Upside Foods and Eat Just’s Good Meat. It was a milestone moment for the industry. But for consumers interested in trying out the much-talked about product, most were out of luck.

Both companies’ cultivated meat products are only available in the food service arena — Upside’s cultivated chicken at Bar Crenn in San Francisco, and Good Meat chicken at one of José Andrés’ restaurants in Washington.

Not only does a taste test require travel, but the dishes come at a pretty penny as well for consumers.

San Francisco’s Michelin-starred Bar Crenn is offering an Upside Foods experience for $150 a person, with limited reservations and waitlists for certain dates. The upscale restaurant is “proud to be the only restaurant in the world” to serve the dish, they said.

In the nation’s capital, consumers at China Chilcano can try Good Meat’s cultivated chicken for $70 a pop as part of the Michelin-starred chef’s tasting menu, but the restaurant can only produce a handful of plates each week because it must be made in small batches.

There are no more regulatory hurdles in order for these cultivated meat items to land on grocery store shelves, attorneys Brian Sylvester and Tommy Tobin of Perkins Coie told Food Dive in an interview. Despite this, neither company is in a hurry to get their products in a grocery store.

In fact, Upside Foods COO Amy Chen told Food Dive in an interview that the cultivated meat maker was still “five to ten years out” from being on grocery shelves.

The consumer mindset

Consumers shop the frozen aisle of their local grocer much differently from how they search a menu. In fact, sometimes consumers won’t eat a product at home but will eat it at a restaurant.

“From a consumer perspective, we've got work to do to educate consumers and get them on board with what cultivated meat is, now that they can try it and put it in their mouths,” Chen said.

The strategy to allow consumers to taste the product exclusively through the hands of a Michelin-starred chef like Dominique Crenn was no accident.

“When you think about the frame of mind of a consumer when they go into a restaurant, they're more open to innovation. They're excited to try new things. They know that a professional chef is going to prepare something that's going to be delicious, and that's an exciting proposition for consumers to experience cultivated meat for the first time,” Chen said.

Among the biggest challenges facing the cultivated meat category is consumer education, according to Sylvester and Tobin. Given the expensive and exclusive nature of restaurants like Bar Crenn and China Chilcano, Upside Foods and Eat Just are far away from getting the general public on board with their products.

“Anybody who has worked in the food business for as long as I have, has seen a lot of different marketing tactics to make a consumer feel guilty about the foods they do enjoy. But solving the problems of food supply chains is really up to the food companies,” Nicole Johnson Hoffman, board member at alternative protein maker Meati Foods, told Food Dive in an interview.

Johnson Hoffman has over two decades of experience in the food and agriculture industry, mostly in the animal protein business at Cargill.

“One thing that’s interesting is that these CEOs are promising a ‘magical experience’, and so I want to know if the dish stands up to that,” said Soleil Ho, restaurant critic at the San Francisco Chronicle on the Fifth & Mission podcast. The critic admitted that the dish had an unpleasant toughness to it.

Two things can happen — people try the product out of curiosity and then never again, or people become repeat consumers once the cost comes down.

”The stakes are very, very high. They have been pouring hundreds of millions of dollars into this industry and if people don’t like the meat, then there’s the big question of what was it all for. This is not just an issue for Upside, but for the whole industry. I think everyone is watching,” said Janelle Bitker, senior editor of Food and Wine at the San Francisco Chronicle in the podcast.

Finally, a puzzle of production

Scale and production costs are also shying players in the space away from retail.

In order for cultivated meat to be comparable in price to animal-based meat, it needs to reach a production cost of $2.92 per pound, according to a report from Reuters.

Neither companies have disclosed their production costs, however in 2021 it was reported to be $17 per pound, missing the mark on price parity by 17%.

When it comes to what hurdles companies will need to cross to get their product ready for retail grocers, that all depends on the stage of technology their production processes are in, Johnson Hoffman said.

“For some companies, their manufacturing lines are the problem. They don’t need anything fancy, just more time for production lines. The hurdles they need to overcome are more so where and how they can find the resources to allow them to grow incrementally, instead of moving production to a bigger plant,” Johnson Hoffman said. “For others, there just needs to be more technological advancements until they are ready to produce at a large scale.”

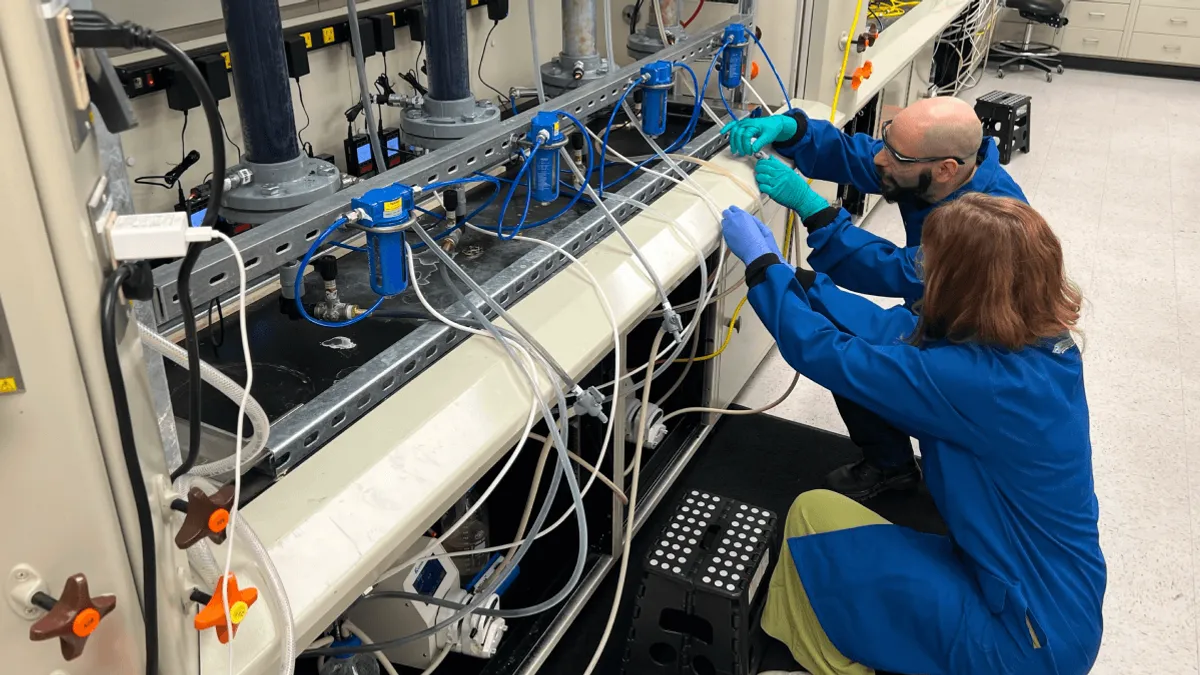

Upside Foods recently announced the opening of their first large-scale production plant, Rubicon. Chen told Food Dive that the company “needed to start thinking much bigger towards large commercial scale production,” which is currently based out of its small plant in the San Francisco Bay area.

This larger plant will help the company make more of its product at a lower cost, the company said, helping it along the long and hard road to retail.

Even though the company’s current facility is lined with bioreactors used for brewing the cultivated meat, Chen confirmed to AgFunder news in an interview that the company is still using 2-liter roller bottles to make its whole cuts, a very expensive and arduous process.

These roller bottles are not mentioned on the company’s website, which outlines its alleged production process of whole cut chicken.

Meanwhile, a recent Wired report revealed mixed messages within the company’s inner workings and what they are putting out to the public. Former and current employees said that claims have exaggerated the company’s capabilities.

Following in the footsteps of plant-based

The foodservice first strategy was also executed by plant-based meat giants Impossible Foods and Beyond Meat.

In July 2016, Impossible Burger was introduced at Momofuku Nishi, a restaurant in New York. This marked the first time the product was regularly featured on a restaurant menu and a commercial introduction of animal-free foods.

Then in 2017, the Beyond Burger was added to the menu at more than 2,000 foodservice outlets including restaurants, hotels, college campuses and professional sports teams’ training camps. The restaurants included, “innovative, single-unit restaurants like Delilah LA, The Moonlighter in Chicago, The Distillery NYC and The Hamilton Inn in Jersey City, that seek to appeal to meat eaters and vegetarians alike,” the company said.

Both companies saw massive growth in their early days, with sales in the space growing 45% overall in 2020 compared to 2019, according to SPINS data released by the Good Food Institute and Plant Based Foods Association. But now, these players have seen a sharp turn in the opposite direction, with signs of a “harbinger of things to come,” said Beyond Meat CEO Ethan Brown in a 2022 earnings call.

Today, the industry has yet to solve the main barriers for trial, with taste, texture and cost leaving many resistant.

Players in the cultivated meat space are using similar strategies, and can potentially look to Impossible and Beyond for some lessons learned.

One difference in strategy lies in the types of foodservice institutions in which Beyond and Impossible first launched their products.

The meat alternative giants chose quick-service restaurants and chains as an entrance to market. This gave them access to a wide net.

One strategy is the same across both spaces: it’s calling on celebrity chefs for endorsements in hopes of establishing a sense of trust with consumers.

Back in 2016, when the Impossible Burger debuted in San Francisco and Los Angeles, the company partnered with prominent high-end chefs Traci Des Jardins of Jardiniére and Chris Cosentino of Cockscomb – who was known for his obsession with meat. Des Jardins actually touted the new offering as a “delicious product.”

Words from celebrity chefs like Dominque Crenn and José Andrés have weight, and only time will tell how influential they can be in this new arena.