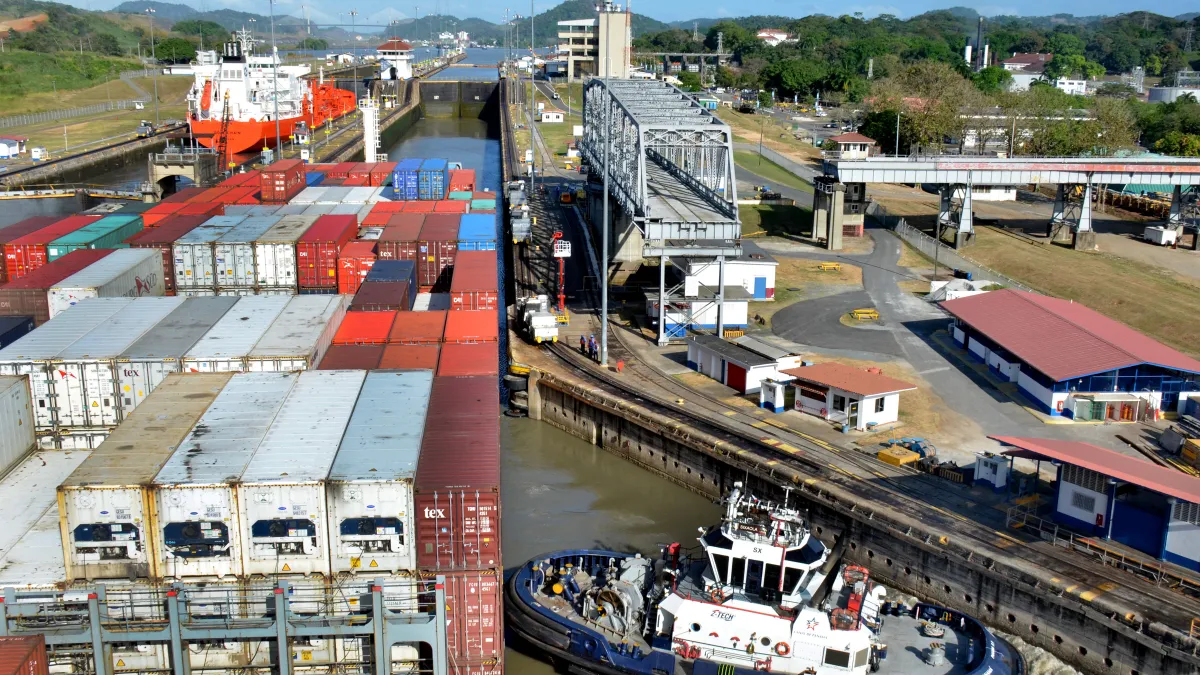

Shippers may need to look for alternative routes to avoid potential cargo delays as disruption threats compound in the Panama Cana.

“Delays at the Panama Canal are now up to 15 days or more and likely to increase," Worldwide Logistics CEO Joe Monaghan told sister publication Supply Chain Dive in an Aug. 11 email. "The full impact of this hasn’t been felt by the importer/exporter community yet since these longer delays have just manifested themselves.”

The delays at the canal come after a dry spring combined with the looming El Niño weather pattern put the shipping channel on alert of low water levels at nearby Gatun Lake. The Panama Canal consequently placed restrictions in June to save water by maintaining a draft of 44 feet, or 13.41 meters, for the following months or until significant changes in weather occur.

“Consequently, the Canal will allow an average of 32 vessels per day to transit during this period,” according to an Aug. 22 news release from the Panama Canal. "This draft adjustment is essential because changes in precipitation patterns are expected to affect water availability in Panama, reflecting a global phenomenon, and with the looming possibility of an El Niño condition before the year's end."

This level compares to a daily average of 33 vessel arrivals per day in June, and a high of 49 vessels that month, according to the canal’s June operations summary.

Low water levels lead to delays, diversions

The restrictions are leading to some ocean shipping delays.

The Panama Canal Authority reported 120 ships were waiting to transit the canal as of Tuesday, Aug. 22. However, the organization added big ships — those with a capacity of up to 13,000 TEUs — have not been affected by current restrictions, as they are typically limited to just ten crossings a day.

"The restrictions are particularly affecting trade between China, Japan, South Korea, and certain regions of the U.S., as the Panama Canal facilitates 46% of container movement from northeastern Asia to the U.S.,” SEKO Logistics said in their August client advisory.

Despite increased export growth out of the Pacific Northwest, the Panama Canal is integral to U.S. exports to Asia. Approximately 50% of the tonnage going through the canal is from the trade lane between the East Coast of the U.S. to Asia, according to Rabobank.

Agriculture products are some of the main commodities transported, particularly grains and oilseeds. Last year, the U.S. exported more than 26% of soybeans and 17% of corn through the Panama Canal, according to Rabobank. It is estimated that U.S. grain exports could be heavily affected should water levels continue to remain low heading into October.

To mitigate delays, shippers are already diverting freight or considering their options, logistics providers said.

Disruptions in maritime shipping have been consistent over the past few years, whether it's port congestion or the infamous blockage of the Suez Canal in 2021. In response, shippers have learned to divert cargo — this time, their options include longer intermodal routes and alternative shipping lanes

"We have already started to see an increase in requests for trans Suez vessels, " Worldwide Logistics' Monaghan said in an email. "We anticipate seeing an increase in demand for intermodal options via the west coast including mini-landbridge and transload to over the road alternatives.”

The Panama Canal acknowledged ongoing diversions in an Aug. 22 news release, saying: "The freedom to choose is vital. We understand that our customers have choices, and it's our duty to ensure that our services remain the best option. If circumstances demand, and customers choose another route temporarily, we respect and understand their decision. Our primary focus remains on the reliability of our services."

Shippers who choose to divert freight will have to accept longer lead times and potentially higher costs, said Niels Madsen, vice-president of product and operations at Sea-Intelligence.

“This could be to ship USEC cargo via USWC ports (risk of congestions in USWC ports) or to route services via Suez Canal instead (longer transitime and potentially higher costs),” Madsen said in an email to Supply Chain Dive.

Ocean rates rise while carriers avoid surcharges

In terms of shipping costs, rises in Transpacific ocean rates have been mainly driven by a series of general rate increases as peak season volumes have gone up, rather than canal-related fees, Freightos Head of Research Judah Levine said in an Aug. 15 email.

But as of Aug. 21, logistics platform Container xChange reported there had also been a spike in spot freight rates due to capacity reductions from the canal, cofounder and CEO Christian Roeloffs said in a market update.

Multiple ocean carriers have said that beyond changes to ocean rates, they are not implementing additional fees.

Maersk, Hapag-Lloyd and ONE told Supply Chain Dive in early August that they had not implemented any additional fees during the water restrictions at the Panama Canal.

Hapag-Lloyd did announce a low water level surcharge in June to be implemented in July, but the carrier never followed through with it, Hanja Maria Richter, corporate communications manager at Hapag-Lloyd told Supply Chain Dive in an Aug. 15 email.

Evergreen, MSC and Zim did not immediately reply to a request for comment. CMA CGM declined to comment, but the carrier did implement a $300 per container Panama Canal surcharge, starting as early as June 1 on some trade lanes.

Nathan Owens contributed to this story.